I attended the Crux Informatics virtual conference on Data and Environmental, Social, and Governance (ESG) Investing this week and found it very insightful. (You can watch both day 1 and day 2 of the conference here.)

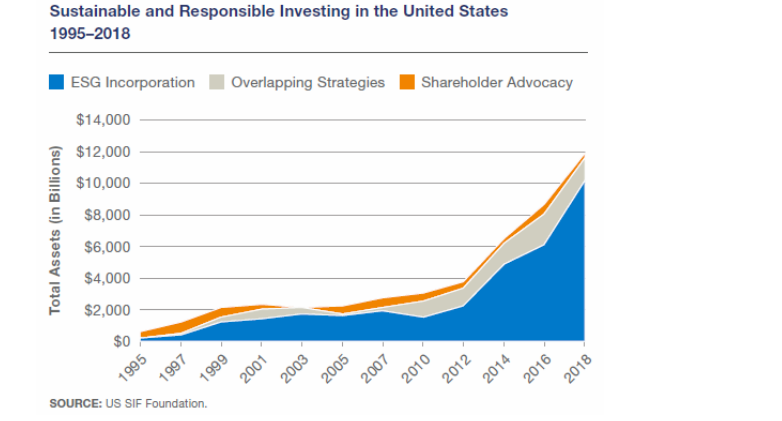

It was very gratifying to see that ESG investing is finally proven in the investment industry: It’s no longer a “right thing to do,” but rather a fundamental part of “what a modern asset manager is about.” (Both quotes from conference panelists.) Today’s asset owners, such as major pension funds, understand that ESG is as much a part of their mandate as investment returns, while fund managers are seeing better investment results from companies with stronger ESG. As a result, ESG investing has grown at an impressive pace:

What’s ahead, though, is even more exciting.

ESG is now becoming an integral part of investing. The superior performance of ESG investments have shown that companies which are environmentally conscientious, hire the best from a diverse talent pool, and integrate with their communities will be the more successful ones long term. So portfolio managers and analysts are starting to look actively at companies’ ESG activities, not as an overlay but as a part of their investment process.

For ESG to realize its full potential, though, it must overcome some key challenges:

- Too few companies are reporting ESG. To remedy this, stock exchanges are starting to recommend, and will probably one day require, ESG reporting from publicly traded companies.

- Private companies are not reporting ESG. This includes not just small to medium enterprises (SME’s) but also companies owned in private equity portfolios. Overtime, as more publicly traded companies report ESG, they will require their supply chain partners to report them as well. Meanwhile, asset owners will probably request the same ESG metrics from their private equity and venture capital managers as their public asset managers.

- There are still too many reporting surveys and standards. As ESG investing has matured, it will probably gravitate towards major standards such as GRI, SASB, and the new EU Sustainable Finance Taxonomy.

- The reported data is of low quality. This is the dirty secret of ESG today: It’s based on companies self-reporting on surveys. So it shouldn’t surprise anyone that there are inconsistencies and outright falsifications out there. (See “Four Things No One Will Tell You About ESG Data” and “Larry Fink Isn’t Going to Read Your Sustainability Report” for more on this.)

We see this all the time for The Next Big Thing: Once a new technology emerges, it must be robust enough to meet the expectations of a broader market or risk sinking back into disillusionment. Video streaming didn’t take off until there was enough people with broadband internet connections, while virtual reality is still waiting for something better than a big, bulky headset.

For ESG investing, the key is:

Will there be enough high-quality ESG data?

In other words, will enough companies release ESG data to enable ESG-based indices that reflect the overall market? Will ESG data be detailed and accurate enough for portfolio managers to use them to make better investment decisions? Will rating agencies be able to build credit default models that incorporate ESG data? Will pension funds and endowments be able to require all their managers to invest with ESG, because that is the new standard for investing?

For ESG to continue to grow, become more relevant, and eventually central to all investment decision-making, it will all depend on data. Not just a few pieces of data that’s expensive to collect, out of date by the time it’s available, and of questionable accuracy. We need timely, trustworthy data that could be gathered easily from companies big and small, public and private, across many industries and up and down the supply chain.

Fortunately, a revolution in data is coming. The combination of blockchain and IOT will make this possible.

Stay tuned…